Semperian’s Portfolio

The Semperian portfolio is one of the UK’s largest and most diversified portfolios of Public-Private Partnership (PPP) infrastructure assets.

With a strategic focus on long-term, inflation-linked returns.

The portfolio is designed to deliver stable, predictable income streams that align with the long-term liabilities of Semperian’s institutional investors.

Scale and Diversity

Semperian’s success has been achieved through its Scale, Control and Diversity.

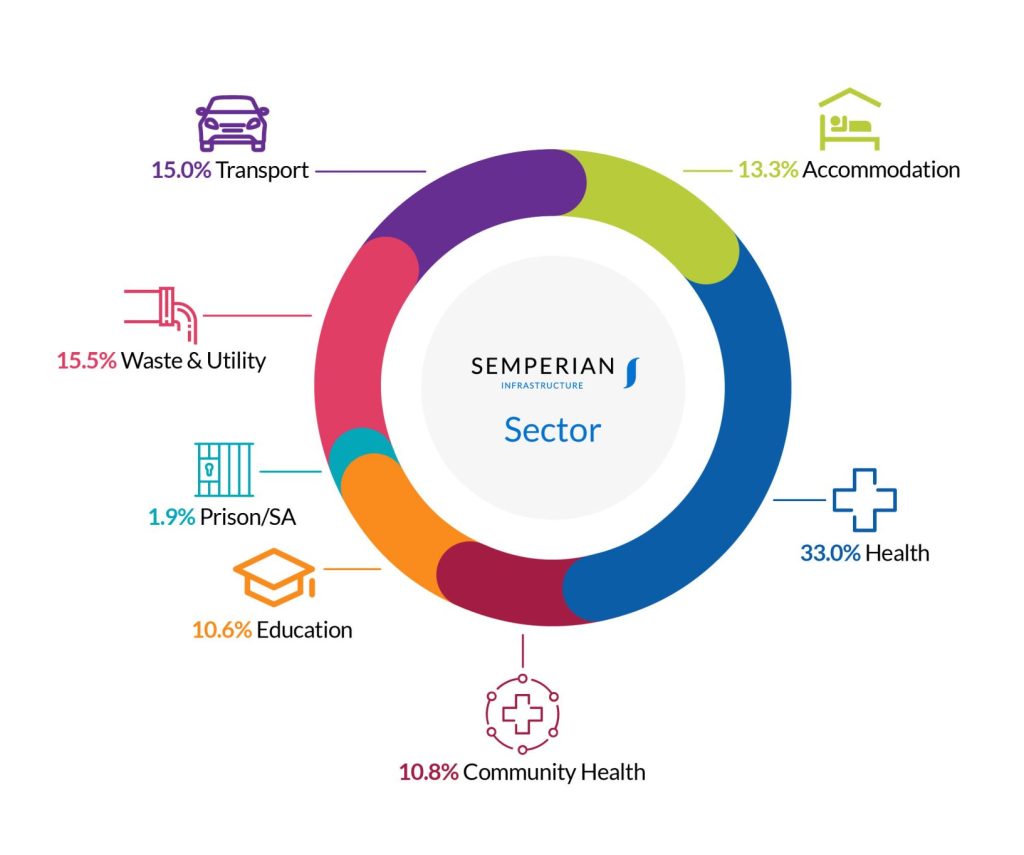

Semperian holds interests in 97 assets across the UK, spanning critical sectors such as:

- Healthcare – with more than 13,000 hospital beds across the UK

- Education – including over 160 schools, and providing education facilities for over 140 thousand pupils

- Accommodation – covering 500 thousand square metres

- Transport – including 1,250km of road infrastructure

- Secure Facilities – providing critical Ministry of Justice infrastructure across the UK

- Waste Processing – of over 1.9 million tonnes per annum diverted from landfill and converted into electricity

The assets are predominantly availability-based, with 85% of future income derived from government-backed contracts. This structure ensures minimal exposure to demand risk and provides a high degree of income certainty.

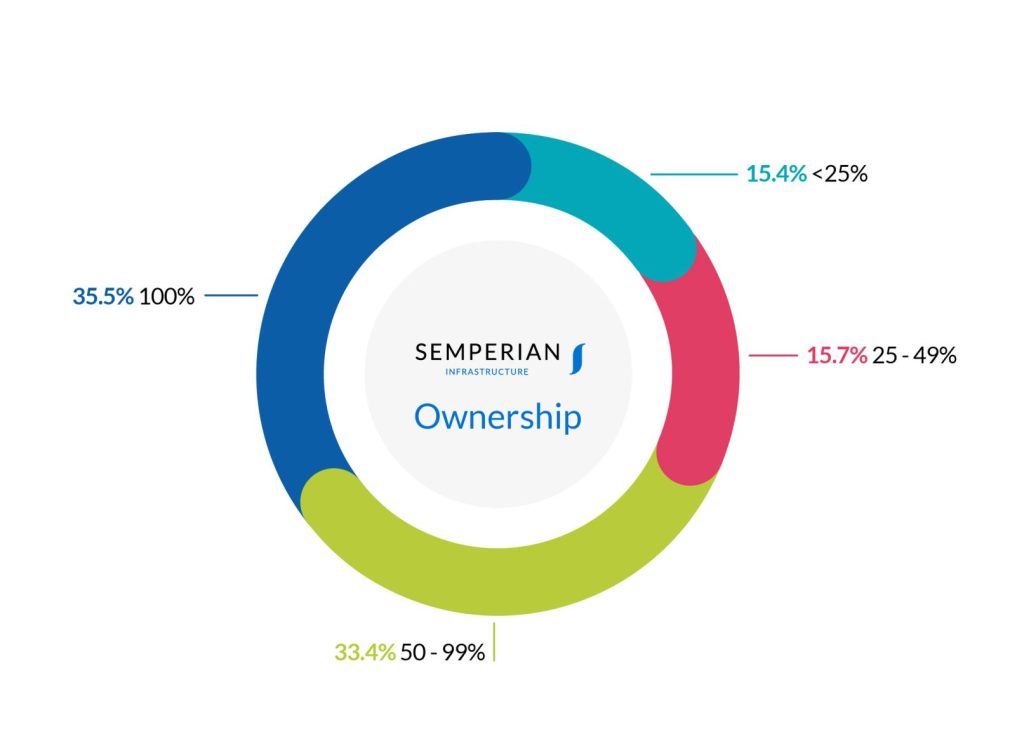

Ownership and Control

We maintain a controlling stake in over two-thirds of our portfolio, with an average ownership level of 77% per asset. This enables us to actively manage performance and risk, while ensuring alignment with our investors’ interests .

Longevity and Resilience

The average remaining life of our investments exceeds 15 years, reflecting the long-term nature of our commitments and the enduring value of the infrastructure we support. Our portfolio is structured to withstand economic cycles, with inflation-linked cash flows and negligible construction risk.

Operational Excellence

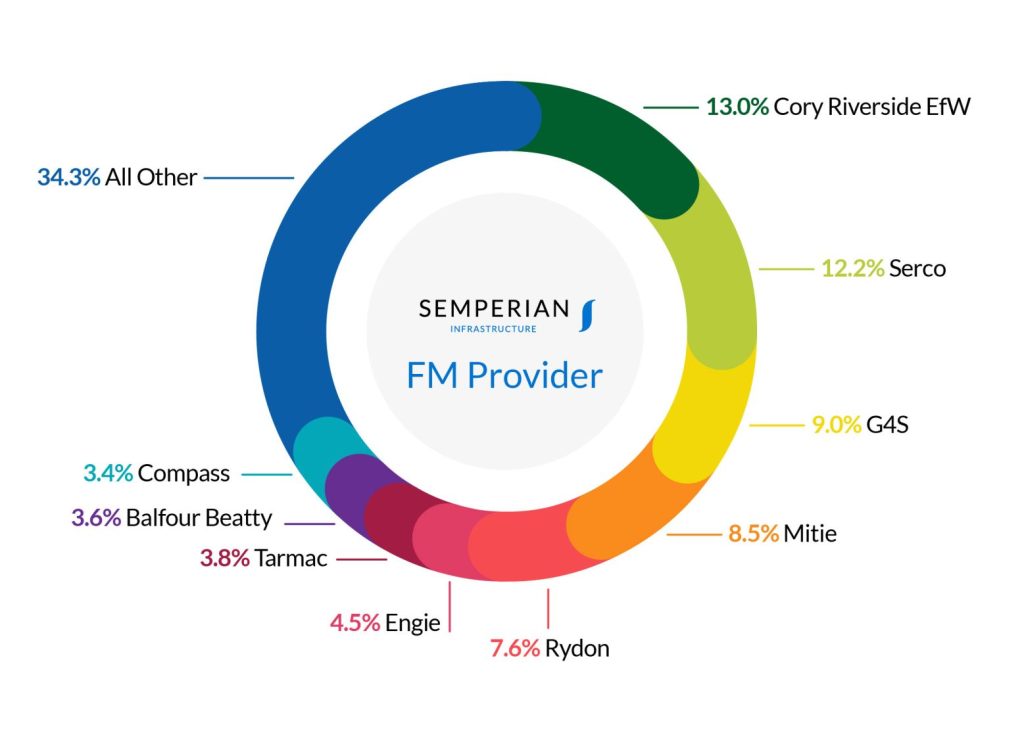

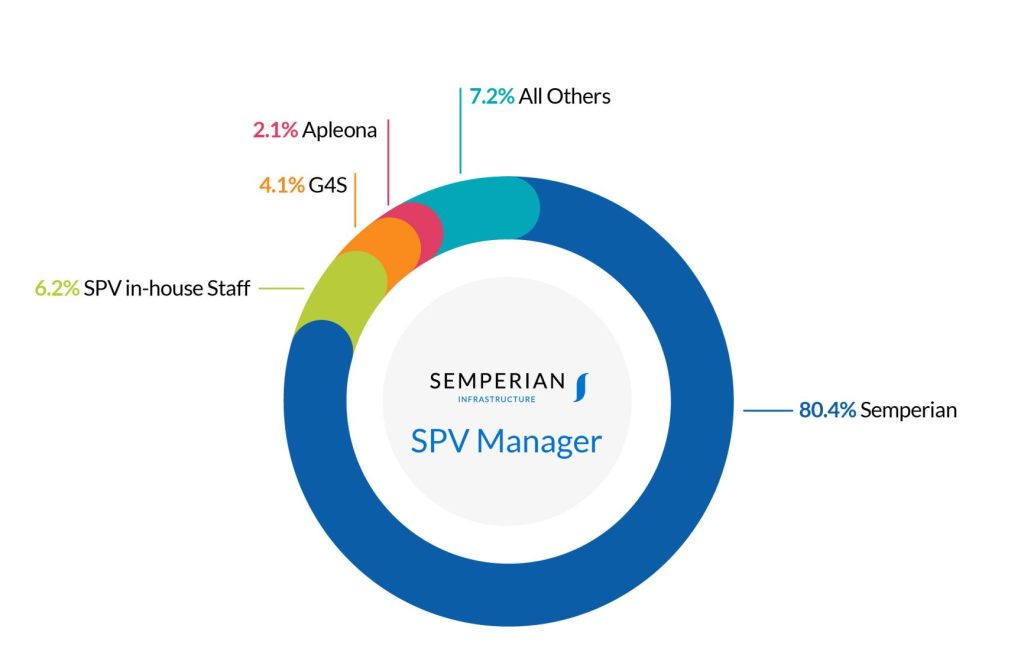

Semperian works with a wide range of Facilities Management providers and Management Service providers, but our preferred model is self-delivery through Semperian Asset Management (a subsidiary of Semperian Management Group), which manages the majority of our assets. This approach enhances operational control and service quality across the portfolio

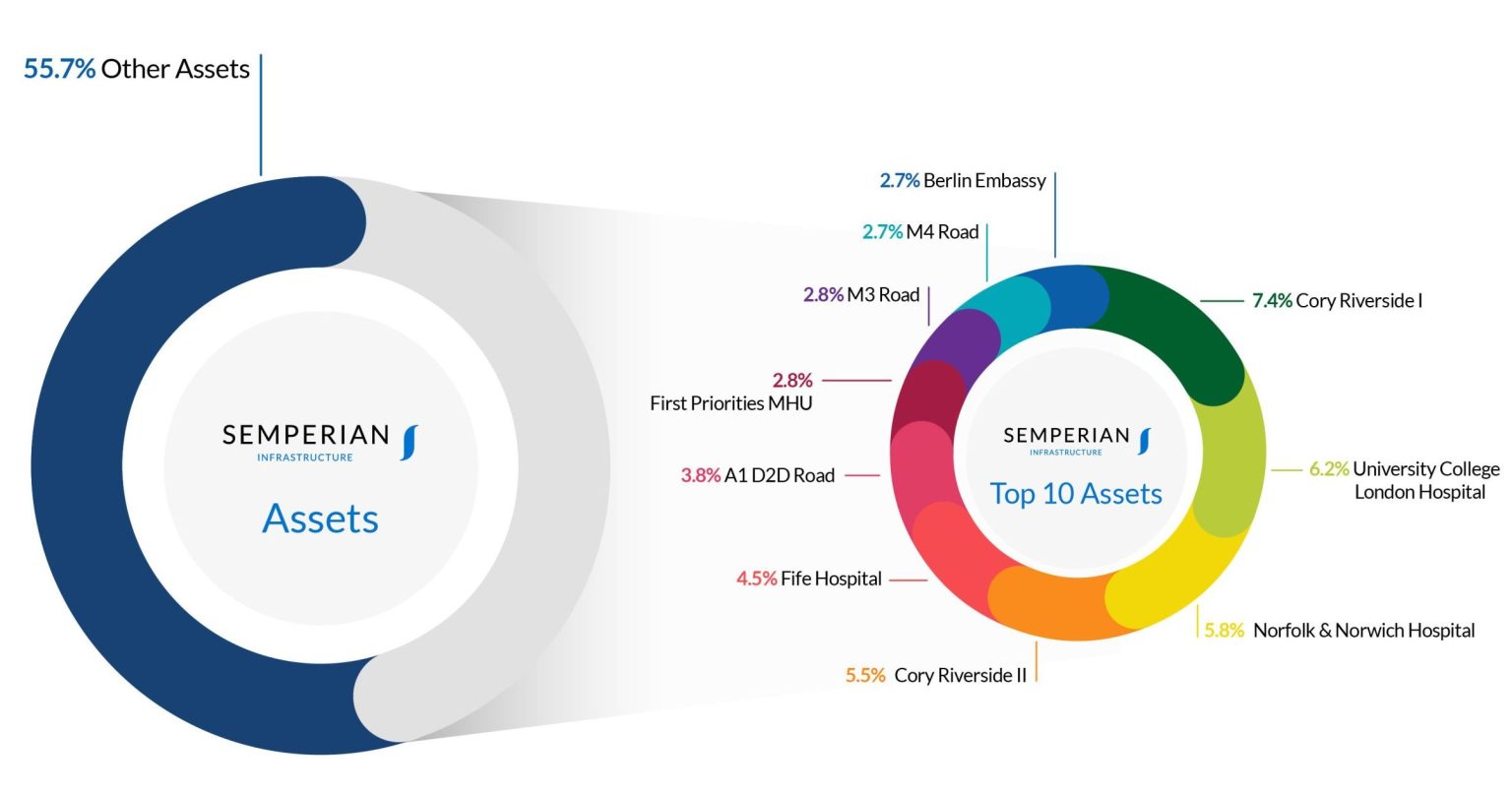

Semperian has one of the largest portfolios of PPP assets, with the largest asset representing less than eight per cent of the portfolio.

- Semperian owns an interest in 97 assets, with the following characteristics:

- Mostly Availability based income source, providing 85% of future income

- Negligible Construction risk across the portfolio

- High degree of asset control, with an average of 77% ownership of each asset

- The average remaining life of the investments is in excess of 15 years

- Semperian owns an interest in 97 assets, with the following characteristics:

- Mostly Availability based income source, providing 83% of future income

- Negligible Construction risk across the portfolio

- High degree of asset control, with an average of 79% ownership of each asset

- The average remaining life of the investments is in excess of 19 years

- Semperian owns an interest in 97 assets, with the following characteristics:

- Mostly Availability based income source, providing 83% of future income

- Negligible Construction risk across the portfolio

- High degree of asset control, with an average of 79% ownership of each asset

- The average remaining life of the investments is in excess of 19 years

- Semperian owns an interest in 97 assets, with the following characteristics:

- Mostly Availability based income source, providing 83% of future income

- Negligible Construction risk across the portfolio

- High degree of asset control, with an average of 79% ownership of each asset

- The average remaining life of the investments is in excess of 19 years

Semperian’s preference is to self deliver the SVP Mangement through SAM, who manage the vast majority of the assets.

- Semperian owns an interest in 97 assets, with the following characteristics:

- Mostly Availability based income source, providing 83% of future income

- Negligible Construction risk across the portfolio

- High degree of asset control, with an average of 79% ownership of each asset

- The average remaining life of the investments is in excess of 19 years

Our Assets

Semperian’s assets are predominantly located throughout the United Kingdom but Semperian also holds substantial interests in assets located in the Republic of Ireland as well as across continental Europe.